Search results

Companies Can't Issue Debt Fast Enough With 88 Deals in 72 Hours

Bloomberg via Yahoo Finance· 10 hours ago...Mortgages Tick Up Across the USAmericans Are Racking Up ‘Phantom Debt’ That Wall Street Can’t...

Europe's rush for rate cuts shifts global market power away from US

Reuters· 8 hours agoThe Bank of England has sent a new signal that borrowing costs will fall earlier and further across ...

Report: Scholz to head ticket even if SPD does poorly in Europe vote

dpa international via Yahoo News· 16 hours ago"Olaf Scholz is the chancellor, and he will remain so. And he will also be our candidate again,"...

Xi Touts China-Hungary Relations as a Good Blueprint for Europe

Bloomberg via Yahoo News· 5 hours agoUp Across the USAmericans Are Racking Up ‘Phantom Debt’ That Wall Street Can’t TrackMarjorie Taylor...

Butch Vig on His Friendly Rivalry With Steve Albini: ‘He’d Stick These Little Jabs in Me’

Rolling Stone via Yahoo News· 4 hours agoThat’s the way it was set up if you went to a major label, with almost every band I knew. I was in a...

Earnings call: HanesBrands reports solid Q1 with focus on growth and debt reduction By Investing.com

Investing.com· 6 hours ago(HBI) has released its first-quarter financial results, showcasing sales in line with expectations...

Why Cavan Sullivan, hyped as the world’s best 14-year-old soccer player, chose to turn pro with the...

Philly.com· 12 hours agoCavan Sullivan hadn’t even played a second of professional soccer when the world started crowning...

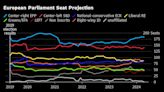

Musk Is Engaging With Europe’s Far Right But Voters Aren’t So Sure

Bloomberg via Yahoo News· 1 day agoBut the controversies have come with a cost in the polls, as they struggle to maintain momentum...

Air Baltic Sells Europe’s Highest-Yielding Bond This Year

Bloomberg via Yahoo Finance· 1 day ago(Bloomberg) -- Air Baltic Corp AS had to offer Europe’s highest coupon bonds so far this year to...

Earnings call: Kamada Limited reports robust Q1 2024 growth By Investing.com

Investing.com· 2 hours agoKamada Limited (NASDAQ:KMDA), a specialty biopharmaceutical company, has reported a strong start to...